Chengdu Auto Show today’s car news:

1. Frigate 07 made its debut at the Chengdu Auto Show

2. H-DOG makes its debut at the Chengdu Auto Show

3. BJ60 announced the opening of pre-sale

Frigate 07 is here, and another SUV is unveiled at the Chengdu Auto Show

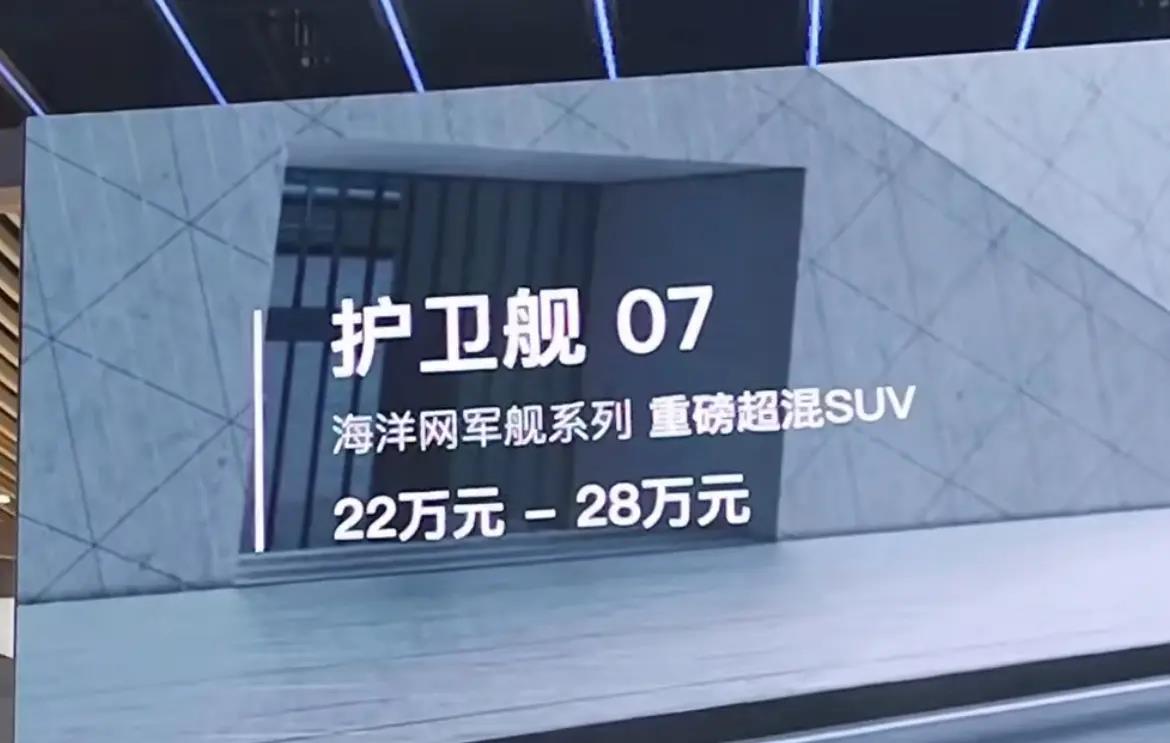

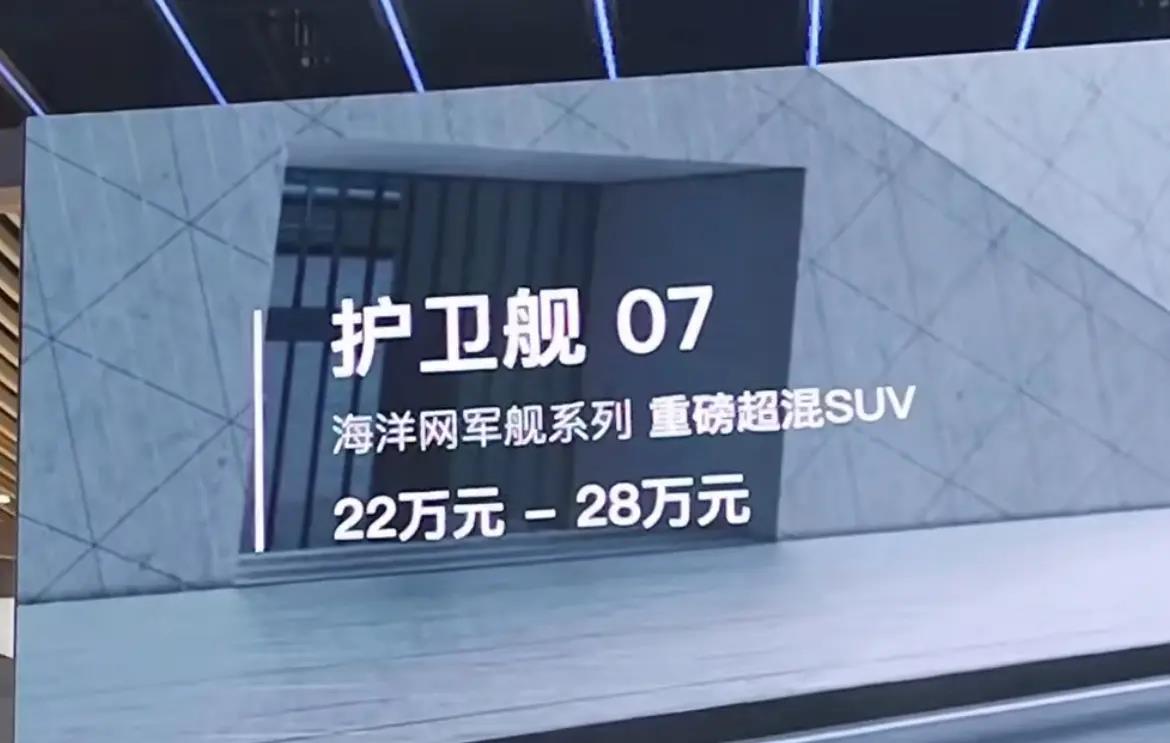

The latest news from Express News, another blockbuster SUV model frigate 07 of the marine sales network warship series has just made its debut at the 2022 Chengdu Auto Show, which opened today, and announced that the estimated price is 22-280,000 yuan, which will be listed for sale at the end of this year.

Frigate 07

Frigate 07 price range

From the body shape, body length, width and height of the Frigate 07, 4820/1920/1750mm, and wheelbase of 2820mm, it can be seen that the Frigate 07 is actually a large 5-seat medium-sized SUV developed on the basis of Tang, but the styling design adopts a new design of the Ocean Network, which looks more honest.

Frigate 07

Frigate 07

According to the information given, the Frigate 07 will be a large 5-seat model with a DMi hybrid system. The fuel engine will still have a maximum horsepower of 139 horsepower and a 1.5T engine. In addition to the DM-i and DM-p two sets of hybrid systems, the pure electric cruising range is available in 100km and 200km versions, which is slightly lower than the Tang hybrid model.

Frigate 07

With the recent addition of Dolphin, Seal, Destroyer, and Frigate 07 to the Ocean Sales Network, the Ocean Network’s models have become more abundant. I believe this Frigate 07 will also attract great market attention. We will bring you a test drive experience report in the future. Please look forward to it.

Weird and cute, H-DOG is launching at the Chengdu Auto Show, so it’s better to call it a hot dog

After Big Dog and Kugou, the car has released a new member of the "dog" family at the 2022 Chengdu Auto Show – H-DOG. Although the car does not have a Chinese name yet, we have all helped it think about it. It is better to call it Hot Dog!

H-DOG

So far, we can summarize the similarities in the styling of the "dog" family. They all have a pair of round headlights, and the front and body contours are relatively square, which makes them look more hardcore. The H-DOG basically retains the above characteristics, and it is more strange than the previous two predecessors, but also a little cute.

H-DOG

The length, width and height of the H-DOG are 4705/1908/1780mm respectively, and the wheelbase is 2810mm, which is much larger than the big dog and Kugou. Its interior design is also more hardcore, and the passenger position also has a set of hardcore off-road symbol armrests, but the details can show a sense of refinement.

H-DOG interior

H-DOG

Of course, the H-DOG also has obvious differences from Big Dog and Kugou. It will be equipped with a 1.5T + 2-speed DHT-PHEV powertrain, which means that it is a plug-in hybrid model with a total power of 240 kilowatts, a total torque of 530 Nm, and a pure electric cruising range of 50-150km. Therefore, this is also a representative product of the "Dog" family entering the new energy market.

H-DOG

Not long ago, the DHT equipped with the lemon hybrid DHT system was officially launched, and the plug-in hybrid version of the DHT-PHEV was also launched for pre-sale. Obviously, the car is now transitioning to the new energy field, and the official even announced that it will stop production of fuel vehicles in 2030.

H-DOG power system

Now that the Lemon Hybrid DHT system has begun to be popularized in the car’s models, this ambitious planning goal is not difficult to achieve. If the hybrid models are more affordable, I believe consumers will be more receptive to these new technologies, and the transition will be faster.

Pre-sale price 239,800 yuan, BJ60 with a low price for the market, you give some face?

Chengdu auto show, BJ60 announced the opening of pre-sale, pre-sale price of 23.98-28 9,800 yuan, in addition, the official during the pre-sale also gave a good discount package, including 3000 yuan deposit deducted 6000 yuan car purchase, lifetime free maintenance and lifetime free road assistance, 2 years 0 interest and so on.

As a hardcore off-road vehicle with a non-load-bearing body, the BJ60 has created a more refined image of an urban SUV in terms of styling. Although the overall design still highlights the hardcore style, it does lack the roughness of those bad guys. This design should be able to be praised, right?

In terms of size, the BJ60 has a length, width and height of 5040/1955/1925mm, and a wheelbase of 2820mm. It is a medium and large SUV. The wheelbase is a little shorter than that of ordinary passenger cars, but this is an appropriate concession for the off-road passability of the whole vehicle. And the BJ60 is not small in size and burly, so there is already enough space in the car for you to use.

The interior design was obviously more luxurious, with leather, piano paint, and chrome-plated decorations all giving it a sense of luxury. There was also a mountain pattern on the trim in front of the co-pilot, which was very ceremonial. There were also some shortcomings, such as the full LCD instrument panel and the central control screen. The size was larger, but it would be better to be more delicate.

Of course, if you say that a real off-road tough guy pays attention to these, then… in fact, there is nothing wrong with it. After all, this is also an off-road vehicle equipped with a time-sharing four-wheel drive system, equipped with front, middle and rear three locks, which can amplify the torque of the transfer by 2.54 times. Who still looks at the display screen when off-road? Right?

As for the power part, the BJ60 is equipped with a 2.0T engine + 48V light mixing system, is equipped with an 85L fuel tank, and provides a 35L sub-fuel tank installation space. After installing the sub-fuel tank, a total of 120L of oil can be filled, and 1000 yuan will be gone after filling a tank of oil. Although it will be heartache when refueling, when crossing no man’s land, it is full of security.

Before the launch of the BJ60, there had been rumors that the BJ60 would compete with the Tank 500, but from the perspective of price and power selection, the BJ60 obviously made a competitive difference. In terms of positioning, the BJ60 was higher than the Tank 300 and lower than the Tank 500. This was a market where the tank had not yet developed, and it was precisely because of this that the BJ60 could have an "opportunity".

At present, BJ60’s product strength and price have shown good competitiveness, but in the end, the brand perception and product quality of BJ brand have always been inferior to the emerging brand of tanks. As a former off-road old gun, BJ is constantly losing has the voice over. BJ60 can be said to be the last model of BAIC off-road. In the constantly sluggish market, whether BJ60 can plant this straw for life, let’s wait and see.