Titanium media note: On January 31, Beijing time, Tesla released its financial report for the fourth quarter of 2018 and its annual results. According to the financial report, Tesla’s revenue in the fourth quarter was 7.23 billion US dollars, an increase of 120% compared with 3.23 billion US dollars in the same period last year; The net profit attributable to ordinary shareholders was $139 million, compared with a net loss of $771 million in the same period last year. This is also the second consecutive quarter of profit for Tesla. In the third quarter of 2018, Tesla achieved a net profit of 312 million US dollars.

With the continuous profitability, other financial indicators of Tesla also continued to rise. For example, the gross profit of Model 3 continues to be above 20%; Tesla’s cash and cash equivalents in the fourth quarter were $3.7 billion, an increase of $718 million from the end of the previous quarter. Tesla expects capital expenditure of about $2.5 billion in 2019.

It is worth noting that due to the decline in sales revenue of ZEV points, Tesla’s gross profit of automobile business declined slightly in the fourth quarter. According to the financial report data, Tesla’s auto business income in the fourth quarter was $6.323 billion, an increase from $6.099 billion in the third quarter, but its gross profit decreased from 25.8% in the third quarter to 24.3%. Correspondingly, Tesla’s ZEV points income in the third quarter was $52 million, and in the fourth quarter it was less than $1 million.

One factor that can’t be ignored is that due to the increase of import tariffs in China, Tesla lowered the prices of some Model S and Model X, resulting in a decline in the gross profit of these two flagship models.

Thanks to two consecutive quarters of strong profits, Tesla’s full-year performance in 2018 also performed well.According to the financial report, Tesla’s annual revenue in 2018 was US$ 21.461 billion, the highest revenue since the company was founded. Although there was still a net loss of US$ 976 million, compared with the huge loss of US$ 1.961 billion in 2017, the performance data in 2018 has been significantly improved.

This achievement is undoubtedly attributed to Model 3. In 2019, with the investment and operation of the China-Shanghai factory, Model 3 began to achieve localized coverage in Greater China. Backed by the world’s largest new energy vehicle market, Tesla’s future trend will undoubtedly add more variables.

In the fourth quarter, Tesla delivered 27,607 Model S and Model X vehicles, and delivered a total of 99,475 Model S and Model X vehicles throughout the year, which was not much different from Tesla’s delivery results in the past.

Tesla also expressed this concern in the financial report. On January 1, 2019, the federal tax relief for electric vehicles will be reduced, and the purchase demand of Model S and Model X will be advanced to 2018, which will lead to a rapid increase in the market share of the above two Model S. "Model S has occupied 38% of the US market share, and it is expected that the delivery volume of Model S and Model X in the first quarter of 2019 will be slightly lower than that in the first quarter of 2018." Tesla said.

The delivery volume of Model 3 is still strong. In the fourth quarter, Tesla delivered a total of 63,359 Model 3s, which continued to increase from 56,065 in the third quarter.

In order to ensure delivery efficiency, Tesla added 27 sales and service outlets in the fourth quarter. By the end of this quarter, Tesla had 378 outlets worldwide.

"If necessary, our service center is shifting to two-shift operation, so as to quickly increase the service capacity. At the same time, we have added the function of Tesla application to arrange services to improve responsiveness and convenience." Tesla said in the financial report.

Corresponding to the delivery capacity, Tesla’s production capacity is facing extreme climb. In the third quarter, Tesla’s weekly production capacity has reached 5,300 vehicles per week. By the end of the fourth quarter, Tesla’s production capacity is increasing to 7,000 vehicles per week. Tesla said that the production capacity of each module of Model 3 can now reach 7,000 per week, and the vehicle production capacity will reach this level before the end of the year, and will continue to produce with this capacity.

Tesla said that in the first quarter, the company will begin to deliver Model 3 in Europe and China. At the same time, in the middle of this year, Tesla will launch a $35,000 standard version of Model 3.

However, in Musk’s view, Model 3 still has huge demand in the world. "According to my guess, if the economic performance is strong, the annual demand for Model 3 worldwide can reach 700,000 to 800,000 vehicles; If the economy falls into recession, this figure may be 60% off. Even in this case, the global annual demand should be slightly lower than 500,000 vehicles. " Tesla CEO Musk said in the earnings conference call.

How to meet this demand, Tesla’s China factory came into being. According to Tesla’s plan, in 2019, that is, by the end of this year, Tesla’s Shanghai factory will be initially completed. Musk said that it will be a complete production line, including stamping, painting workshop, body connection and assembly workshop.

The initial production capacity target of the Shanghai plant is 3,000 vehicles per week, and the production capacity of the fremont plant is 7,000 vehicles per week. In 2019, Tesla Model 3 will achieve a production capacity of 10,000 vehicles per week.

"If there is no accident at the Shanghai factory, we will achieve the goal of producing more than 500,000 Model 3 units between the fourth quarter of 2019 and the second quarter of 2020." Tesla said in the financial report.

It is reported that Tesla’s Shanghai factory has been filed by the Shanghai Development and Reform Commission. In the conference call, Musk predicted that in order to achieve the initial weekly output of 3,000 vehicles, the capital expenditure may be roughly 500 million US dollars. In addition, the construction funds of Tesla Shanghai factory have found a solution.

Tesla CFO Deepak Ahuja said that the land of the Shanghai factory is leased from the government and has a 50-year lease term. "Most of the funds for the Shanghai factory will come from local banks in Shanghai. The details are under discussion and will be announced at that time."

Compared with the lack of cash flow in the past, Tesla is now actively talking about the road to profitability. On the evening of January 18th, Beijing time, elon musk, CEO of Tesla, suddenly sent an internal letter, announcing that the company would lay off 7% of its staff, leaving only the most critical temporary workers and contractors, which was regarded as a cost-cutting measure.

In fact, Tesla had already made a layoff before it made a profit in the third quarter. In addition to reducing personnel expenses, Tesla’s efforts in the construction of service facilities also showed obvious signs of contraction in the third and fourth quarters.

According to the information disclosed in the financial report, Tesla built a total of 293 super charging stations in 2018, and opened 69 and 44 in the fourth and third quarters respectively. That is to say, the number of super charging stations opened in the second half of the year was almost half that of the first half.

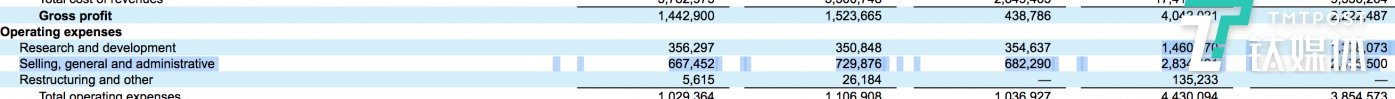

Judging from the fourth quarter financial report data, Tesla’s series of cost reduction plans have achieved fruitful results. The general, administrative and marketing expenses, which had occupied more than 20% of the revenue for a long time, reached 667 million US dollars in the fourth quarter, accounting for less than 10% of the revenue. Moreover, with the simultaneous increase of service facilities and sales outlets, the general, administrative and sales expenses in the fourth quarter were still lower than those in the third quarter.

Of course, compared with operating expenses, whether Model 3 is in a productivity hell, the quarterly delivery is only a few hundred units in 2017, or in 2018, when Model 3 delivered 60,000 units in the third quarter, the operating expenses are almost flat. This shows that Tesla’s direct sales model will gradually reduce the proportion of costs generated by the direct sales service system after the rapid increase in product delivery, which also provides a positive reference for Weilai Automobile, which has a loss of up to 2.8 billion yuan in a single season.

In addition to the popular Model 3, Tesla’s other small SUV Model Y is obviously a walking model. In the earnings conference call, when asked when Model Y will be mass-produced, Musk replied, "Model Y needs a relatively large factory, and the initial output will be relatively low. It always takes time to increase production capacity, which is difficult to predict and may be before the end of next year."

At the same time, Tesla’s electric truck Semi may go offline this fall. "The place of production depends on the supplier, assembly and user." The relevant person in charge of Tesla said.

Tesla CEO Musk also took the initiative to disclose information about Tesla pickup trucks. "Tesla pickup trucks may be available this summer, which is a very unique model."

With the release of the financial report, Tesla also announced a major personnel change.Tesla CEO Musk said in a conference call that Deepak Ahuja, the chief financial officer who has served the company for nearly 11 years, is about to retire, and Zach Kirkhorn, vice president of the company’s financial business, will take over his position. He was previously a business analyst at McKinsey.

Tesla’s share price also fluctuated with the incident. After continuous profit but less than expected, Tesla’s share price experienced a 5% decline and then turned up, followed by a 2% increase, which was fixed at $308.8 per share. However, since then, news of Deepak Ahuja’s retirement has come out, and the decline has once again exceeded 5% to $293.8.

Tesla expects that the revenue in 2019 may increase with the increase of delivery volume: the goal is to deliver 360,000-400,000 vehicles, which is about 45%-65% year-on-year. (This article is the first titanium media, author/Li Qin)

关于作者