In the first half of the year, cosmetics sold 207.1 billion yuan.

Since the beginning of this year, the cosmetics market has shown great vitality and potential.

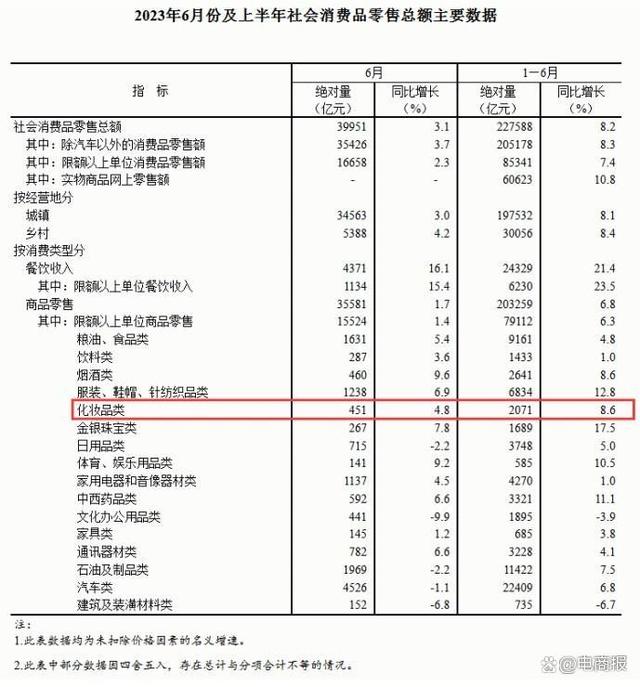

On July 17th, the National Bureau of Statistics released data showing that in the first half of 2023, the total retail sales of social consumer goods was 22,758.8 billion yuan, up 8.2% year-on-year, of which the retail sales of cosmetics products was 207.1 billion yuan, up 8.6% year-on-year. In the first half of this year, the total retail sales of cosmetics exceeded 200 billion yuan for the first time, the highest level in history.

(Source: National Bureau of Statistics)

Among them, domestic cosmetics are not only popular in China, but also popular in overseas markets. According to the customs export data, the export of cosmetics rose steadily in the first five months of this year, the export volume and amount of beauty cosmetics and toiletries maintained a certain increase, and the demand of foreign consumers for domestic cosmetics has been greatly improved.

(Source: official website, General Administration of Customs of the People’s Republic of China)

In addition to the growth of the overall market, the performance released by some beauty listed companies has also increased, turning losses into profits.

Recently, the beauty leader Polaiya Cosmetics Co., Ltd. released the semi-annual performance forecast for 2023. It is estimated that the net profit of returning home in the first half of this year will be 460 million yuan to 490 million yuan, which will increase by 163 million yuan to 193 million yuan compared with the same period of last year, increasing by 55% to 65% year-on-year. It is worth mentioning that in the first quarter of this year, the growth rate of revenue and net profit of Polaiya was close to 30% year-on-year.

(Source: Polaiya official website)

Shanghai jahwa United Co., Ltd. predicts a net profit of 285 million yuan to 315 million yuan in the first half of the year, an increase of 81% to 100%. According to the company, in the first half of 2023, through the recovery growth of domestic business, the company digested the pressure of overseas business and achieved good business results.

Market participants said that according to the current growth trend, the cosmetics market will once again break through the 400 billion mark at the end of the year. All kinds of situations show that the beauty industry is recovering strongly, and China’s cosmetics market has shown strong market resilience and growth space.

2. Say goodbye to the cold winter and the beauty market will pick up.

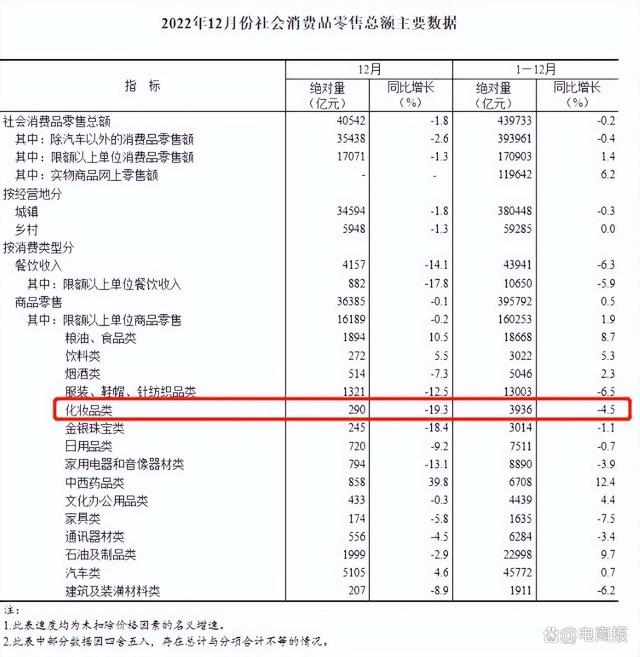

Last year, it was considered by many people in the industry to be the coldest year in the cosmetics industry. According to the retail data of social consumer goods in 2022 released by the National Bureau of Statistics, the total retail sales of cosmetics in 2022 was 393.6 billion yuan, down 4.5% year-on-year. This is the first time that the total retail sales of cosmetics has experienced negative growth in the past decade.

(Source: National Bureau of Statistics)

Compared with last year’s overall negative growth, this year’s cosmetics retail data can still maintain a growth trend for six consecutive months, indicating that the beauty industry’s prosperity is constantly picking up and the market is continuing to pick up. So what is the reason for the strong recovery of the beauty market?

The macro environment, macroeconomic stability and improvement are quite key factors. With the social and economic recovery, the desire for beauty consumption is rising, which drives the growth of retail sales. Similarly, the company’s performance increase is inseparable from the recovery of offline channels and the continuous empowerment of online channels. The market is picking up, and the promotion of e-commerce activities has contributed. In the first half of this year, the March 8th Women’s Day was promoted and the 618 event was held, and major brands seized consumer demand, which obviously led to the outbreak of the beauty market. The data shows that from 33 billion yuan of cosmetics sales in May to 45.1 billion yuan in June, an increase of over 36.6% month-on-month, which is a huge increase. It is not difficult to see the positive promotion of 618.

(Source: National Bureau of Statistics)

With the development of the industry, the competition of beauty track is becoming more and more fierce, and the rising of domestic beauty brands is the obvious trend of current market development.

At present, China has become the second largest cosmetic consumption market in the world. With the huge consumption prospect in China, the beauty market in China has attracted many overseas beauty brands. In the past, compared with overseas brands, China’s cosmetics industry had a thin foundation, a late start and a low reputation. In the same stage competition, domestic beauty brands performed slightly worse. Now the situation has changed.

According to industry insiders, at present, national cosmetics brands are rising strongly to seize market share. This year’s Tmall Fast-moving 618 full-cycle turnover brand list shows that Polaiya has squeezed out OLAY, a brand owned by Procter & Gamble, to become the fourth.

Domestic beauty brands have also gone abroad, attracting a large number of overseas consumers. With the upsurge of traditional culture in China sweeping the world, Chinese makeup has brought fire to domestic beauty products. With culture and oriental aesthetics as the carrier, domestic beauty products such as porch-window box, concentric lock lipstick and snuff bottle liquid foundation have gone global and been sought after by overseas consumers. The packaging of products like Hua Xizi has been integrated into the traditional culture of China, creating a unique brand positioning and successfully gaining the attention of overseas consumers.

3. The beauty track ushered in the second half

The growing beauty market has attracted a lot of players, and the industry competition is intensifying. Under the trend of more mature consumers, weaker traffic dividends and improved industry supervision, the pattern of beauty industry will be reshuffled. In the fierce competition situation, market opportunities and challenges coexist. How should beauty brands be laid out?

The beauty industry accelerates the survival of the fittest. When the tide gradually recedes, deep R&D strength is indispensable for enterprises. Increasing product research and development and patent investment, enhancing product competitiveness with science and technology, and strengthening the cultivation of "internal strength" can help enterprises go further and longer in the industry. Empowering by science and technology can ensure the stability of product safety and efficacy, and brands with strong R&D strength are expected to occupy a larger market share.

Under the background of declining online traffic dividend and continuous price involution, the overall environment of the beauty industry has recovered, and offline channels have gradually stabilized. It is a way for the company to turn its attention to offline channels to increase revenue and profit. Beauty brands will build offline channels, continuously deliver products, and realize better realization by undertaking the traffic overflow after online investment.

E-commerce needs to find offline growth points, and it is the general trend to create a diversified channel layout under the beauty line. Some brands that once focused on online began to vigorously lay out offline channels. Polaiya, whose online channel accounted for over 90% of its main business income last year, said recently that this year will be the first year of its offline restart, and it will focus on the daily chemical channel and the department store channel. Freda Bio, which owns many effective skin care brands, such as Dr. Yael and Yilian, recently announced that it will fully launch offline this year, and proposed to build an offline market scale with a total return of 350 million yuan in the first year, covering the goal of 200 million offline consumers.

Nowadays, the beauty market is constantly subdivided, and market participants say that enriching the product matrix and making efforts in the mid-to high-end market may become the way for enterprises to break the ice. In China cosmetics market, the middle and high-end market is mainly occupied by foreign brands. In recent years, with the improvement of China’s cosmetics brand building ability and R&D strength, consumers have a strong desire to support domestic products, and some brands have begun to enter the high-end market, including Mao Geping and Polaiya, from which we can see the potential and possibility of local enterprises to develop high-end beauty cosmetics.

Generally speaking, the current domestic beauty consumption fever continues to rise, and the growth of retail sales has boosted industry confidence. In the next stage, with the economic recovery and consumption recovery, the cosmetics market is still promising. However, in the process of gradually restoring confidence in the cosmetics consumer market, enterprises with technology and strength can truly remain invincible in the market.

关于作者